Risk vs. Reward: A Practical Guide for High-Achieving Investors

By Gaurav Kumkar, CEO of Majestic Investment Group

At Majestic Investment Group, we have high income and net worth doctors, technologists, and business professionals who have built careers and wealth through hard work and smart decisions.

It’s important to understand about risk versus reward. Get this balance wrong, and you either leave money on the table or lose sleep (and capital) you can’t afford to lose.

No two people have the same comfort level with risk. A 35-year-old surgeon with young children thinks differently from a 62-year-old tech founder planning retirement. Thus, someone’s investment choices may not be appropriate for everyone.

Biggest risk is not taking any because the money or cash is constantly losing value against money printing, inflation, assets appreciating. Investors need to understand “all investing involves risks”.

Quotes from Warren Buffett that are absolutely must to be an quality investor:

- “If you cannot control your emotions, then you cannot control your money.”

- “The most important quality for an investor is temperament and not intellect.”

At Majestic we provide opportunities, analysis, due diligence, risk diversification but we are NOT financial, legal, tax, retirement advisors. Being a technologist turned full time investor, dont claim that we are Warren Buffett nor we claim to be Elon Musk, therefore, utilizing tools and frameworks to become better investors, learning from each other one opportunity at a time!

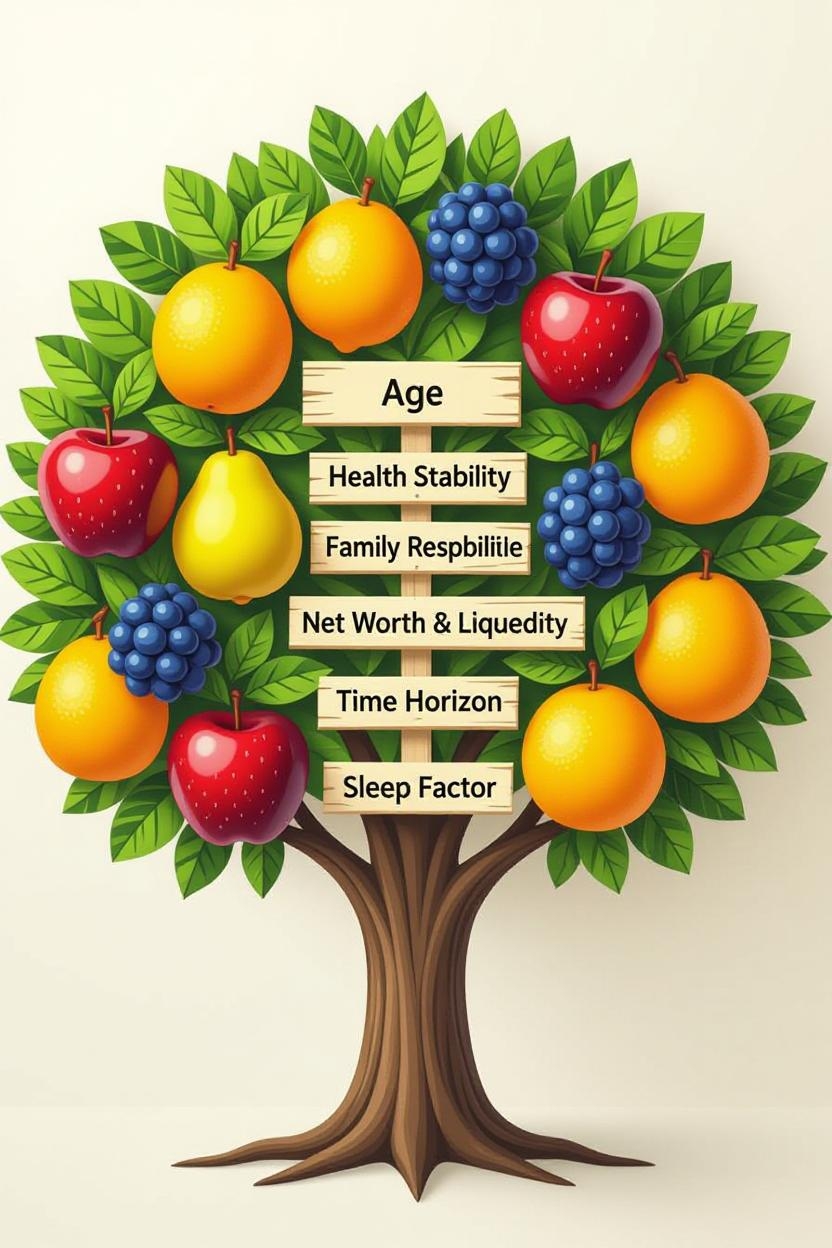

Why Risk Appetite Is Personal

Risk tolerance comes from objective facts (your numbers) and subjective feelings (your gut).

Factor |

What It Means |

Example |

|

Age |

Younger investors have more time to recover from losses. |

A 40-year-old can ride out a dip; a 70-year-old may not want to. |

|

Health |

Poor health can force early retirement or big medical bills. |

Someone with a chronic condition keeps extra cash handy. |

|

Income Stability |

Steady paycheck = more room to take calculated risks. |

A tenured physician can explore more than a startup founder. |

|

Family Responsibilities |

Kids in college, aging parents, or a non-working spouse change the math. |

Supporting three dependents usually means lower risk. |

|

Net Worth & Liquidity |

More assets = ability to lock up money longer. |

$1M liquid lets you try more riskier investments |

|

Experience |

Wins build confidence; losses teach caution. |

An investor who lost in 2008 avoids anything “speculative.” |

|

Time Horizon |

When do you need the money back? |

Retirement in 5 years = preserve capital. 20 years = grow it. |

|

Sleep Factor |

Can you check the numbers at 2 a.m. without panic? |

If a 20% drop ruins your week, stay conservative. |

Step-by-Step Framework to Pick Your Comfort Zone

- Review Your Snapshot Notice patterns. Are you leaning toward safety or growth? Do most factors point to protecting what you have, or do they give you room to reach further?

- Match Your Comfort to Rewards You Want Different assets deliver different payoffs. Pick the ones that fit both your profile and your goals.

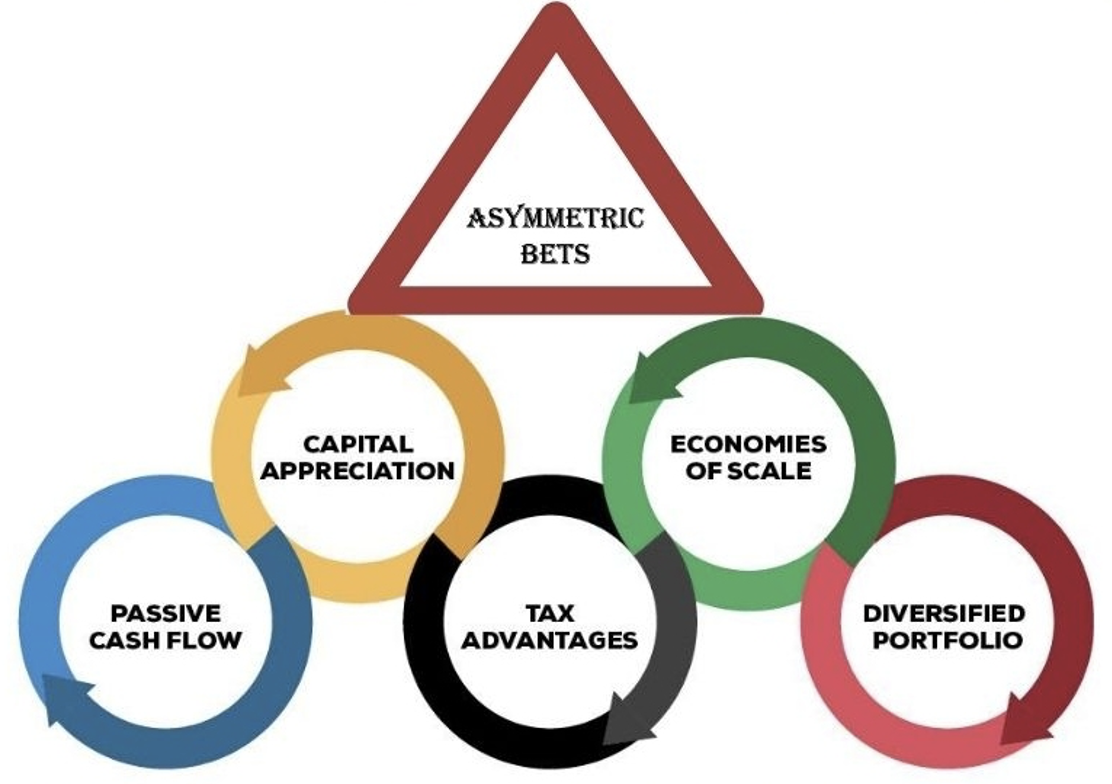

Reward |

What It Means |

|

Passive Income |

Monthly or quarterly cash flow with little work. |

|

Tax Efficiencies |

Depreciation, cost segregation, or energy credits that cut your tax bill. |

|

Capital Appreciation |

Value grows over time; sell later for a lump sum. |

|

Asymmetric Bets |

Small money in, big money out if it hits. |

|

Economies of Scale |

Bigger deals spread costs and boost returns. |

|

Diversification |

Spreads risk across unrelated assets. |

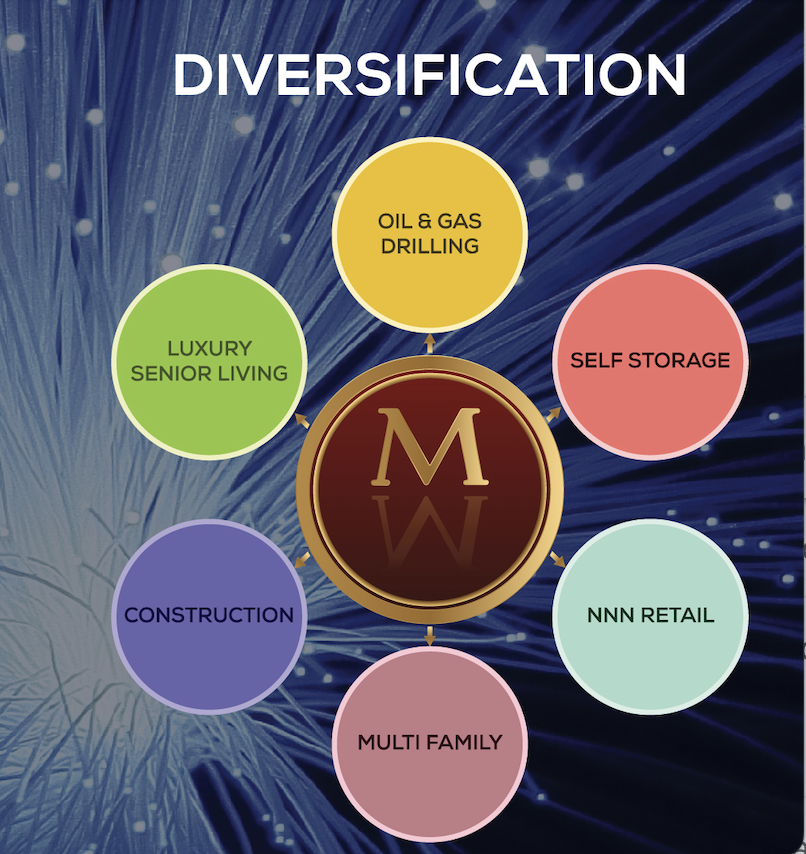

Choose Your Asset Mix

Use the table below. It shows risk level and primary rewards for seven popular asset classes.

|

Asset Class |

Risk Level |

Primary Rewards |

|

Senior Living |

Lowest |

Passive income, tax efficiencies (depreciation), diversification |

|

Self-Storage |

Low to Medium |

Passive income, capital appreciation, low overhead |

|

Multifamily |

Low to Medium |

Passive income, tax efficiencies, economies of scale |

|

Retail NNN (Triple Net Lease) |

Low to Medium |

Passive income, long-term stability, inflation hedge |

|

Construction (Value-Add or Ground-Up) |

Medium to High |

Capital appreciation, tax efficiencies, economies of scale |

|

Venture Capital |

High |

Asymmetric bets, capital appreciation, diversification |

|

Oil & Gas Drilling |

High |

Asymmetric bets, tax efficiencies (intangible drilling costs), passive income (if producing) |

Final Thought

Risk is not the enemy; mismatched risk is. Not educating or Not thinking for yourself is risk. Biggest risk is in-action!

Personally, I have high risk tolerance and entreprunership abilities to explore, try, learn, lose, win and swing for the fences. Therefore, investors are encouraged to read, review, learn, think and own their own decisions. There is no room to blame anyone, its YOU, no one else is responsible.

Concluding in Warren Buffett's words:

“You have to be able to think independently, and when you come to a conclusion you have to really not care what other people say. Just follow the facts and your reasoning.”

Legendary Investor References

|

Investor |

Core Risk Philosophy |

Key Tactic for Risky Investments |

Resource |

|

Warren Buffett |

Permanent capital loss from ignorance |

Long-term hold in understandable businesses with margin of safety |

Berkshire Annual Letters |

|

Ray Dalio |

Balanced exposure via uncorrelated assets |

Risk parity in "All-Weather" portfolios |

"Principles: Life and Work" |

|

Peter Lynch |

Inherent in pursuit of growth; mitigated by research |

Buy undervalued growers hold through volatility |

"One Up on Wall Street" |

|

Howard Marks |

Multifaceted (e.g., hidden biases); essential for returns |

Contrarian buys; avoid losers via deep analysis |

Oaktree Memos Archive |

Greatest Entrepreneurs References

Jeff Bezos - Founder AMAZON

“Swing for the fences. You’ll strike out 9 times out of 10. but that one hit can score 1,000 runs. Big winners pay for so many experiments.”

Elon Musk

- "There's a tremendous bias against taking risks. Everyone is trying to optimize their ass-covering."

- "It’s OK to have your eggs in one basket as long as you control what happens to that basket."

- "If things are not failing, you are not innovating enough."

- "The most I can lose is the cost of the experiment. What’s the most I can gain? A lot!"

- "When you’ve had success for too long, you lose the desire to take risks."

- "Wouldn't let anyone invest more than a token amount in early SpaceX/Tesla—failure probability >90%.".

- Musk's philosophy: Fail forward, iterate relentlessly, and prioritize velocity over perfection to outpace complacency.

- "Failure is an option here. If things are not failing, you are not innovating enough." (From a 2005 Fast Company interview on SpaceX's culture.)

- "My estimate of the probability of success at the beginning of both Tesla and SpaceX was less than 10%. The reason people telling me we would probably fail didn’t dissuade me was that I already agreed with them!" (X post reflecting on early risks.)

- "You should take the approach that you’re wrong. You should always be asking yourself, 'What am I wrong about?'" (From a Norway energy conference interview on humility in innovation.)

- "When something is important enough, you do it even if the odds are not in your favor." (On pursuing goals despite likely failure.)

Elon is Founder of following and not yet retired :)

- Zip2: Co-founded in 1995 with his brother, Kimbal Musk, the company provided online city guides with maps for newspapers.

- PayPal: Co-founded as X.com in 1999, it merged with Confinity to become PayPal before being acquired by eBay.

- SpaceX: Founded in 2002 to reduce space transportation costs and eventually enable the colonization of Mars.

- Tesla: Became an early investor and chairman in 2004, and later CEO, though not an original founder.

- SolarCity: Provided the initial concept and financial capital for this solar energy company, which was founded by his cousins in 2006 and later acquired by Tesla.

- OpenAI: Co-founded in 2015 as a non-profit AI research company but later left the board.

- Neuralink: Co-founded in 2016 to develop implantable brain-computer interfaces.

- The Boring Company: Founded in 2017 to create underground transportation tunnels.

- X (formerly Twitter): Acquired the social media company in 2022.

- xAI: Founded in 2023, this artificial intelligence company aims to develop "maximum truth-seeking AI".